In this blog post, we’ll explore what the potential implications are for personal financial planning as flood damage costs continue to rise in the UK.

A guide to investment strategies

Considering your needs

The first thing to do is think about your financial requirements. This includes not only your current levels of income and spending, but the money you will need in the future. And this future planning is both about having the cashflow to maintain the lifestyle you want, and preparing for other costs, such as care. In fact, one of the first questions you might be asked is whether there are other ways of meeting your requirements, apart from standard market investments.

There is also likely to be a conversation about emergency funds – do you have any? How can you build them up? Perhaps you have too much cash in the bank and that money could be working harder for you elsewhere. The job of a financial planner is to look solely at your status and needs and give you relevant advice that reflects your short, medium and long-term requirements.

Your investment philosophy

Part of putting your personal investment strategy together is to find out what you are interested in and comfortable with. This includes finding out what level of risk you are most comfortable with. All investment presents a risk – you might want your pension to be a lower-risk investment but an ISA to be higher risk, for example. By understanding how you feel, your financial adviser can look at funds that are most suitable for you. This also applies to types of funds – for example, at Switchfoot Wealth, we recommend sustainable funds as the default option, because they make long-term financial sense, but you may choose to invest in funds that support other industries.

Spreading the load

It’s generally good practice to make sure that investments are diversified enough to protect the investor and their money. Of course, this depends on the overall wealth of each client and their respective needs, but the aim is to protect the money, and to put it in places where it will grow – depending on the markets, of course.

If you are looking for reputable independent financial advice, or would like to review your current investment strategies, Switchfoot Wealth can help. Contact us today to make an appointment.

For Professional Fiduciaries. Not aimed at retail clients.

I started Switchfoot Wealth to offer financial planning that matches the way we live and work today. Using the best technology and offering expertise gained through both formal qualifications and years of working closely with clients, we are bringing financial planning into the 21st century, helping people, businesses and professional advisers make the most of their time and their money.

– Sebastian Ewell

Switchfoot Wealth Founder

Read more about Switchfoot Wealth

Related Articles

The Rising Cost of Flood Damage in the UK: What it Means for Your Personal Financial Planning

Webinar for home care providers

We welcome SOLLA Affiliate member Claire Edwards of Claire Edwards Eldercare for a presentation designed for home care providers. We discuss the benefits of SOLLA and being a SOLLA Affiliate and also discuss how to support people with continuing health care funding...

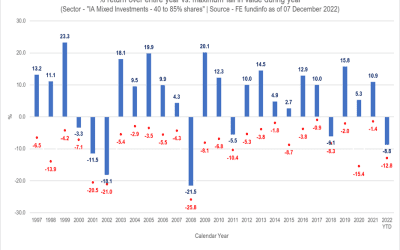

Mind the Gap

Mind the Gap “My investments have reduced in value”. In 2022, this has been one of the main reasons that new clients have shared as to why they are now seeking financial advice. No-one relishes seeing red when logging in to see their investments. However, it’s...

SwitchFoot Wealth Limited is an appointed representative of Sense Network Limited which is authorised and regulated by the Financial Conduct Authority. SwitchFoot Wealth Limited is entered on the Financial Services register (www.fca.org.uk/register) under reference number 808196.

Registered Address: 28 Upper Hale Road, Farnham, Surrey, GU9 0NS. Principal Office: 147 Frimley Road, Camberley, Surrey, GU15 2PS. Registered in England & Wales No.: 11220173.

The information contained within this website is subject to the UK regulatory regime and therefore restricted to consumers based in the UK.

The Financial Ombudsman Service is available to sort out individual complaints that clients and financial services business aren’t able to resolve themselves. To contact the Financial Ombudsman Service, please visit www.financial-ombudsman.org.uk.

Recent Comments