In this blog post, we’ll explore what the potential implications are for personal financial planning as flood damage costs continue to rise in the UK.

The challenges of the Sandwich generation

Written by

The challenges of the ‘Sandwich’ generation

Children growing up and sitting exams; parents requiring more care and attention; trying to keep your career on track – these are the challenges of the so-called ‘Sandwich’ generation. If this sounds familiar, it’s probably because you’re either already in this situation or you can see it looming on the horizon. It can be an extremely difficult time of life – and even more so if you have legal responsibilities to someone you love.

Acting as an attorney for a loved one

As people become more aware of the importance of making a Lasting Power of Attorney (LPA) well before it’s needed, there has been an increase in the number of people taking on those attorney duties. This is a positive thing, because it’s vitally important that someone – or more than one person – trusted by the individual is looking after their affairs. Trying to do so after the individual’s competence to make decisions has gone is extremely complicated, so it is always best to make your LPA – both for health and finances – as early as possible.

There are a number of legal responsibilities for an attorney, and these responsibilities must be taken seriously and carried out appropriately. These include:

· Always acting in the best interests of the individual

· Taking reasonable care when making decisions on the individual’s behalf

· Acting in accordance with the terms and direction of the relevant LPA

· Involving the individual in decisions wherever practical and reasonable

Making life easier

There are a range of challenges involved with being an attorney for a loved one. The biggest of these is having to make difficult decisions when you are so personally involved in the care of that individual or the outcome of any decision you make. Add in the fact that these are often complex financial or difficult health decisions, and it’s easy to see why things can become stressful.

To add to this pressure, there is often more than one attorney appointed. This might be another family member, or it might be a professional attorney like a solicitor. This is a good thing from the perspective of the individual – it’s an added layer of protection – but it can make it trickier to organise practical things, particularly if the attorneys are not in the same location. Sharing paperwork and keeping track of finances becomes more complicated and can result in additional friction or stress.

Sandwich generation attorneys can use technology to help them manage this part of their lives. Applications like Switchfoot Teams (our preferred financial planning portal for attorneys) allow attorneys – and other relevant professionals – to have oversight of key finances, and to access important documents like the full LPA, share certificates, insurance documents and more. Easy to set up, easy to use and the ideal way to keep a handle on all the different areas you may need to cover as an attorney, this technology can help to manage at least one of the responsibilities you have.

To find out more, speak to us today.

Sandwich generation attorneys can use technology to help them manage this part of their lives

– Sebastian Ewell

Switchfoot Wealth Founder

Read more about Switchfoot Wealth

Related Articles

The Rising Cost of Flood Damage in the UK: What it Means for Your Personal Financial Planning

Webinar for home care providers

We welcome SOLLA Affiliate member Claire Edwards of Claire Edwards Eldercare for a presentation designed for home care providers. We discuss the benefits of SOLLA and being a SOLLA Affiliate and also discuss how to support people with continuing health care funding...

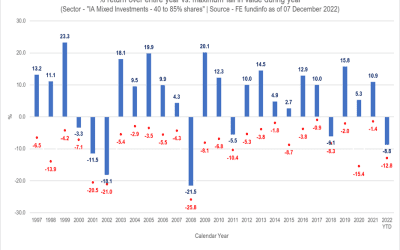

Mind the Gap

Mind the Gap “My investments have reduced in value”. In 2022, this has been one of the main reasons that new clients have shared as to why they are now seeking financial advice. No-one relishes seeing red when logging in to see their investments. However, it’s...

SwitchFoot Wealth Limited is an appointed representative of Sense Network Limited which is authorised and regulated by the Financial Conduct Authority. SwitchFoot Wealth Limited is entered on the Financial Services register (www.fca.org.uk/register) under reference number 808196.

Registered Address: 28 Upper Hale Road, Farnham, Surrey, GU9 0NS. Principal Office: 147 Frimley Road, Camberley, Surrey, GU15 2PS. Registered in England & Wales No.: 11220173.

The information contained within this website is subject to the UK regulatory regime and therefore restricted to consumers based in the UK.

The Financial Ombudsman Service is available to sort out individual complaints that clients and financial services business aren’t able to resolve themselves. To contact the Financial Ombudsman Service, please visit www.financial-ombudsman.org.uk.

Recent Comments