This blog was first published by Lawskills and has been replicated in here, the original article is available on the following link

https://www.lawskills.co.uk/articles/2019/08/safeguarding-in-lpa-administration/

Safeguarding plays a vital role in LPA administration – a case study

John Smith has a fairly complex estate and has recently had a meeting with his financial adviser, who has asked whether he has a Lasting Power of Attorney (LPA). This isn’t the first time his financial adviser has asked the question and John did recently have a work colleague whose wife lost capacity without an LPA in place; he remembers that trying to sort out all the finances and paperwork was incredibly stressful for his colleague.

So he decides that he not only needs to put an LPA in place; he needs to talk to his preferred attorneys to ensure they understand what they are taking on, and that they have access to all the information they need when the time comes.

John chooses a local law firm, and asks them to draft his LPA. He’s nervous because he’s heard that attorneys can take advantage of their powers – particularly over finances – and he wants to make sure that couldn’t happen in his case. He is concerned about losing control of his finances, and about how to make sure his attorneys follow his wishes when they make decisions.

John’s solicitor talks him through the supervision and safeguarding clauses that could be included in his LPA. They discuss the skills and approach that someone in a safeguarding or supervision role would need, and the responsibilities they would have. They also talk about who John might want to appoint as an attorney, and whether they are willing and able to make that commitment.

What makes a good safeguarder?

- Someone who you know is trustworthy

- Someone who has good money-management skills

- Someone who is a good decision-maker

- Someone who has the ability to oversee the duties carried out by the attorney

- Someone who can step in quickly if there is an issue or even a crisis

- John decides to appoint his niece as his attorney, but in addition he would like a professional to supervise the decisions of the attorney once he has lost capacity, checking regularly that everything seems to be in order, supporting his niece if she is in need of guidance and pre-authorised to report any safeguarding concerns. The solicitor adds clauses to the LPA that allows for this option including a charging clause.

In order to avoid any doubt about over the potential conflict of confidentiality and safeguarding duties, the solicitor asks John to sign an advance consent for permission to disclose confidential information to safeguard him and his property. John feels confident that he has an extra layer of security in place which will protect him and his finances when he is most vulnerable.

Maintaining financial transparency

John then wants to know how he can be sure his attorney’s actions will be transparent. His solicitor suggests Switchfoot Teams, which several of her clients use successfully. An online system, it allows attorneys and designated individuals to see what financial transactions have taken place on a real-time basis. This is a deterrent to financial abuse and ensures that all actions are transparent at all times. Accounts production can be automated and the accounts default to a chart of accounts in line with OPG deputy return, offering the best practice available from modern personal accounting. John sets up Switchfoot Teams and invites his solicitor into his ‘Team’.

The solicitor recommends that the following clauses be added to John’s LPA:

‘I direct that my attorneys shall provide access to an online system detailing all of my financial accounts to [insert chosen safeguarder]’

‘I direct that my attorneys shall produce summary accounts including a complete transaction history to [insert chosen safeguarder] on a monthly basis.’

Initially John sets up Switchfoot Teams, providing limited access for his attorney. In years to come, as his ability to manage his affairs decreases, the access level can be increased for his attorney when she needs to support John in his decisions and when she needs to act, providing for a smooth transition. And John can be confident that, if needed, his appointed safeguarder will be able to step in if anything goes wrong.

Partnering with Switchfoot Teams

Switchfoot Wealth has partnered with Switchfoot Teams to provide access to the Switchfoot Teams portal which has been developed to meet the needs of attorneys, deputies and trustees.

To find out more, contact us today.

“

I started Switchfoot Wealth to offer financial planning that matches the way we live and work today. Using the best technology and offering expertise gained through both formal qualifications and years of working closely with clients, we are bringing financial planning into the 21st century, helping people, businesses and professional advisers make the most of their time and their money.

– Sebastian Ewell

Switchfoot Wealth Founder

Read more about Switchfoot Wealth

Related Articles

The Rising Cost of Flood Damage in the UK: What it Means for Your Personal Financial Planning

In this blog post, we’ll explore what the potential implications are for personal financial planning as flood damage costs continue to rise in the UK.

Webinar for home care providers

We welcome SOLLA Affiliate member Claire Edwards of Claire Edwards Eldercare for a presentation designed for home care providers. We discuss the benefits of SOLLA and being a SOLLA Affiliate and also discuss how to support people with continuing health care funding...

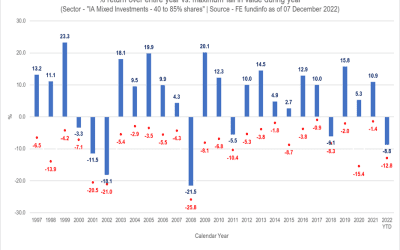

Mind the Gap

Mind the Gap “My investments have reduced in value”. In 2022, this has been one of the main reasons that new clients have shared as to why they are now seeking financial advice. No-one relishes seeing red when logging in to see their investments. However, it’s...

SwitchFoot Wealth Limited is an appointed representative of Sense Network Limited which is authorised and regulated by the Financial Conduct Authority. SwitchFoot Wealth Limited is entered on the Financial Services register (www.fca.org.uk/register) under reference number 808196.

Registered Address: 28 Upper Hale Road, Farnham, Surrey, GU9 0NS. Principal Office: 147 Frimley Road, Camberley, Surrey, GU15 2PS. Registered in England & Wales No.: 11220173.

The information contained within this website is subject to the UK regulatory regime and therefore restricted to consumers based in the UK.

The Financial Ombudsman Service is available to sort out individual complaints that clients and financial services business aren’t able to resolve themselves. To contact the Financial Ombudsman Service, please visit www.financial-ombudsman.org.uk.