Global warming is causing an increase in flood damage costs in the UK. According to a report from Bristol University and Fathom, climate change could lead to a 20% increase in the cost of flood damage in the UK. This has serious implications for personal financial planning, as the cost of flood damage can be devastating, not only in terms of property damage but also for personal finances. In this blog post, we’ll explore what the potential implications are for personal financial planning as flood damage costs continue to rise in the UK.

The impact on insurance premiums

One of the most immediate financial impacts of flooding is on insurance premiums. Flood insurance is expensive and can be difficult to obtain. Insurance premiums have already risen in recent years, and they are likely to continue to rise as the risk of flooding increases. Those living in high-risk flood areas may find that they are unable to obtain flood insurance at all.

The impact on property values

Another financial impact of flooding is on property values. Flooding can cause significant damage to homes, which can lead to a decrease in their value. If your home is in a flood-prone area, this could affect the value of your property and your ability to sell it in the future.

The impact on mortgage rates

The rising cost of flood damage in the UK could also have an impact on mortgage rates. Lenders may be more cautious about lending in high-risk flood areas, which could lead to higher mortgage rates for those living in these areas. This could make it more difficult for people to afford homes in these areas, which could have wider implications for the housing market as a whole.

What practical steps can you take?

You may wish to take steps to reduce the risk of flooding. This could include measures such as installing flood-proofing. By taking these steps, you may be able to reduce the risk of flooding and in turn lower your insurance premiums as well as help protect the value of your property.

How is the Government helping?

The UK government has implemented various policies and initiatives to help manage flood risk. This includes the Flood Re scheme, which is a joint initiative between the government and the insurance industry to ensure that flood insurance remains affordable and available to those in high-risk flood areas. The government also provides funding for flood defence schemes and offers support to those affected by flooding.

Implications for your personal financial plan

The rising cost of flood damage in the UK may have serious implications for your financial plan.

When making future projections of expenditure, it would be sensible to consider what investments you would have to make to protect your home from the increased risk of flooding. Potential increases in insurance premiums should also be considered.

In terms of expectations for the value of your property, it may not be the case that house prices (and therefore the equity you hold) will continue to increase throughout your financial plan. As highlighted, increased flood risk may mean that the value indeed falls in the future.

This illustrates the importance of “stress testing” your financial plan to consider the impacts that climate change could have upon your income, expenditure and assets.

I started Switchfoot Wealth to offer financial planning that matches the way we live and work today. Using the best technology and offering expertise gained through both formal qualifications and years of working closely with clients, we are bringing financial planning into the 21st century, helping people, businesses and professional advisers make the most of their time and their money.

– Sebastian Ewell

Switchfoot Wealth Founder

Read more about Switchfoot Wealth

Related Articles

Webinar for home care providers

We welcome SOLLA Affiliate member Claire Edwards of Claire Edwards Eldercare for a presentation designed for home care providers. We discuss the benefits of SOLLA and being a SOLLA Affiliate and also discuss how to support people with continuing health care funding...

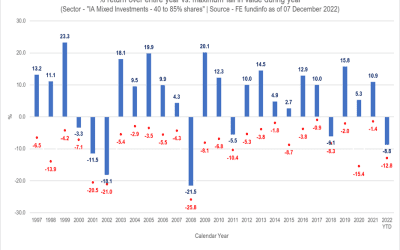

Mind the Gap

Mind the Gap “My investments have reduced in value”. In 2022, this has been one of the main reasons that new clients have shared as to why they are now seeking financial advice. No-one relishes seeing red when logging in to see their investments. However, it’s...

Caring for the Carers

If the health and well-being of the carer deteriorates, then what happens to be person being cared for?

SwitchFoot Wealth Limited is an appointed representative of Sense Network Limited which is authorised and regulated by the Financial Conduct Authority. SwitchFoot Wealth Limited is entered on the Financial Services register (www.fca.org.uk/register) under reference number 808196.

Registered Address: 28 Upper Hale Road, Farnham, Surrey, GU9 0NS. Principal Office: 147 Frimley Road, Camberley, Surrey, GU15 2PS. Registered in England & Wales No.: 11220173.

The information contained within this website is subject to the UK regulatory regime and therefore restricted to consumers based in the UK.

The Financial Ombudsman Service is available to sort out individual complaints that clients and financial services business aren’t able to resolve themselves. To contact the Financial Ombudsman Service, please visit www.financial-ombudsman.org.uk.