Cashflow planning and the 5 Principles of the Mental Capacity Act.

Cashflow planning turns often complex calculations into a set of interactive and visually engaging infographics. Cashflow planning can be used to support vulnerable clients and help their appointed attorneys/deputies meet their obligations under the Mental Capacity Act of 2005 when making financial decisions.

Principles 1 & 2 – A presumption of Capacity (1) and Individuals being supported to make their own decisions (2)

Every adult has the right to make their own decisions and we must assume they have the capacity to do so unless proved otherwise. You cannot assume lack of capacity just because of a particular diagnosis or disability. Capacity is decision-specific; it may fluctuate between lack of capacity and lucid periods. An individual may have capacity over some decisions but not others.

The law is clear: a person must be given all practical help to make their own decisions before they are treated as lacking capacity. This means that attorneys/deputies should make every effort to encourage and support people to make the decision for themselves.

Cashflow planning can help with supported decision making – a case study

Paul has mobility problems and some cognitive impairment arising from a brain injury. His solicitor acts as his court-appointed Deputy.

Paul wishes to purchase a new motorised wheelchair and wants a top of the range model for £20,000. An older version of the same chair is available secondhand for £5,000. Both Paul and his solicitor agree he needs a new chair. The deputy will need to help Paul weigh a range of considerations and decide which chair he should get. Paul and his solicitor may consider any differences in performance, aesthetics, affordability, and so on.

Paul, his deputy, and his financial adviser previously had a cashflow plan. The financial adviser gave Paul access to his plan via a VoyantGo licence. The Deputy is able to log in and create a few ‘What if’ scenarios. A brief discussion with the financial adviser results in charts that show the effect on affordability.

Paul may not be in a position to understand all of the calculations involved but he may be perfectly capable of understanding the potential financial effect of his purchase decision as modelled by the ‘What if’ scenarios.

Paul and his Deputy are now in a better position to take account of the financial implications of the decision. The Deputy is making every effort to support Paul in the decision and involving him as much as possible.

Principle 3 – Unwise Decisions

People have the right to make unwise decisions. You cannot treat someone as lacking capacity because you disagree with their decision or think it unwise. Everyone has their own values and preferencesand may apply different weight to these values.

Returning to our case study, the Deputy believes that buying the £20,000 chair is too risky and jeopardises the long-term affordability of his client’s financial affairs, but perhaps Paul sees it differently: he wants to maximise quality of life and places greater weight on the non-financial factors than the Deputy does and so opts for the more expensive chair, despite the concerns over affordability.

The Deputy can take notes on the decision and keep the ‘What if’ scenarios on file, showing that they carefully considered affordability explain the reasoning behind the ultimate decision.

Principle 4 – Best Interests

Anything done for, or on behalf of, a person who lacks mental capacity must be done in their best interests.

One of the fundamental aspects of Voyant is ‘The Timeline’. This is a great opportunity to document the key milestones, goals and objectives for Paul. Financial decisions can be weighed against their effect on his ability to meet these goals and objectives. Cashflow planning can help show which course of action is likely to be in his best interest.

Principle 5 – Least Restrictive Option

Someone making a decision or acting on behalf of a person who lacks capacity must consider if it is possible to decide or act in a way that would interfere less with the person’s rights and freedoms of action.

In respect of managing ongoing financial affairs, it is helpful for attorneys or deputies to consider if it is possible to leave some control of arrangements to Paul. The question is, how much?

Cashflow modelling can be used by the attorneys or deputy to consider a range of scenarios. What if it all goes wrong, and Paul over-spends? After all, he may have some capacity to make some unwise decisions, but cannot manage all of his finances over a longer term.

The Deputy may choose to set up a separate account for Paul to manage and control how much cash is transferred into it. Cashflow planning can give the deputy or attorney the confidence to take a less restrictive approach to management of the finances and leave as much control as possible and sensible with Paul.

To find out more about how cashflow planning can assist deputies and attorneys to inform their clients and allow the best decisions to be made in light of capacity, you can always contact my team and me at Switchfoot Wealth.

I started Switchfoot Wealth to offer financial planning that matches the way we live and work today. Using the best technology and offering expertise gained through both formal qualifications and years of working closely with clients, we are bringing financial planning into the 21st century, helping people, businesses and professional advisers make the most of their time and their money.

– Sebastian Ewell

Switchfoot Wealth Founder

Read more about Switchfoot Wealth

Related Articles

The Rising Cost of Flood Damage in the UK: What it Means for Your Personal Financial Planning

In this blog post, we’ll explore what the potential implications are for personal financial planning as flood damage costs continue to rise in the UK.

Webinar for home care providers

We welcome SOLLA Affiliate member Claire Edwards of Claire Edwards Eldercare for a presentation designed for home care providers. We discuss the benefits of SOLLA and being a SOLLA Affiliate and also discuss how to support people with continuing health care funding...

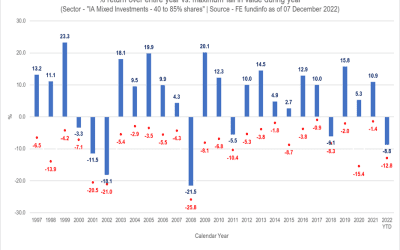

Mind the Gap

Mind the Gap “My investments have reduced in value”. In 2022, this has been one of the main reasons that new clients have shared as to why they are now seeking financial advice. No-one relishes seeing red when logging in to see their investments. However, it’s...

SwitchFoot Wealth Limited is an appointed representative of Sense Network Limited which is authorised and regulated by the Financial Conduct Authority. SwitchFoot Wealth Limited is entered on the Financial Services register (www.fca.org.uk/register) under reference number 808196.

Registered Address: 28 Upper Hale Road, Farnham, Surrey, GU9 0NS. Principal Office: 147 Frimley Road, Camberley, Surrey, GU15 2PS. Registered in England & Wales No.: 11220173.

The information contained within this website is subject to the UK regulatory regime and therefore restricted to consumers based in the UK.

The Financial Ombudsman Service is available to sort out individual complaints that clients and financial services business aren’t able to resolve themselves. To contact the Financial Ombudsman Service, please visit www.financial-ombudsman.org.uk.