In this blog post, we’ll explore what the potential implications are for personal financial planning as flood damage costs continue to rise in the UK.

Retirement and Pensions: Considerations for Business Owners

Written by

When you run your own business, there’s no grand pension scheme or guaranteed retirement age. Instead, you are completely responsible for your retirement planning, including your pension fund. You may need to implement a pension scheme for the workers in your business, and you can pay into this too, but you also need to have a clear retirement plan, which might sit alongside the exit plan for your business.

Why think about retirement now?

If you’re a business owner, you’re likely to be immersed in business plans, new products or services, managing your employees and more. So ‘retirement’ might seem a long way off, and way down your list of priorities.

But it should be at the top of that list. Why? Because it’s likely that your business will provide the foundation for your retirement plans. And how can you plan to grow your business if you don’t know what you want from it at the end of your career?

The sooner you think about retirement and pension planning, the sooner you can start to build up funds and investments that will give you the lifestyle you need in retirement and support the plans and dreams you have for you and your family.

Don’t put all your retirement eggs in one basket

Many business owners think: “I’ll sell my business and that will fund my retirement”. But this can be a dangerous route to take. To begin with, it relies on your business being stable and successful until you retire – and then being saleable at that point. However much we love our businesses, they are not always the big-ticket vehicles we would like them to be. And, as we have seen in 2020, factors outside your control can affect the profitability and even the viability of your business, so instead of banking on selling your business, take the time to do some long-term planning instead.

Think about the tax implications

Retirement and pensions planning isn’t all about working out how you can pay for that round-the-world cruise. It’s also about making sure that your planning – for your business and your personal wealth – is as tax efficient as possible. That’s why you need to talk to an independent financial adviser. They can help you put together a plan that is workable and affordable and has your retirement goals in mind. Working with your business accountant, you and your adviser can see how to structure, grow and manage your business so that it can provide the income you need in the most tax-efficient way.

For example your business could make employers pension contributions to your personal pension which allows for significant tax efficient company pension contributions. By managing your ongoing pension contributions and investments, and having a clear plan for post-retirement investments, you can plan for a secure retirement sooner rather than later.

Investment for good

The way you invest your pension funds can have a significant sustainability and social impact. Many business owners are making the switch to a sustainable investment strategy and this can align with your business’ mission and make an impact on your sustainability goals read more.

A pension is a long-term investment not normally accessible until 55 (57 from April 2028). Your capital is at risk. The value of your investment (and any income from them) can go down as well as up which would have an impact on the level of pension benefits available.

*with thanks to the Centre for Ageing Better Age Positive Image Library for the featured image.

I started Switchfoot Wealth to offer financial planning that matches the way we live and work today. Using the best technology and offering expertise gained through both formal qualifications and years of working closely with clients, we are bringing financial planning into the 21st century, helping people, businesses and professional advisers make the most of their time and their money.

– Sebastian Ewell

Switchfoot Wealth Founder

Read more about Switchfoot Wealth

Related Articles

The Rising Cost of Flood Damage in the UK: What it Means for Your Personal Financial Planning

Webinar for home care providers

We welcome SOLLA Affiliate member Claire Edwards of Claire Edwards Eldercare for a presentation designed for home care providers. We discuss the benefits of SOLLA and being a SOLLA Affiliate and also discuss how to support people with continuing health care funding...

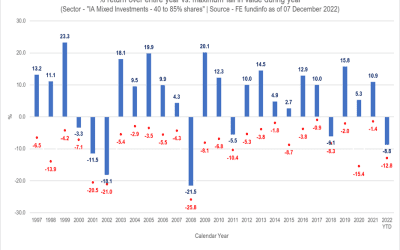

Mind the Gap

Mind the Gap “My investments have reduced in value”. In 2022, this has been one of the main reasons that new clients have shared as to why they are now seeking financial advice. No-one relishes seeing red when logging in to see their investments. However, it’s...

SwitchFoot Wealth Limited is an appointed representative of Sense Network Limited which is authorised and regulated by the Financial Conduct Authority. SwitchFoot Wealth Limited is entered on the Financial Services register (www.fca.org.uk/register) under reference number 808196.

Registered Address: 28 Upper Hale Road, Farnham, Surrey, GU9 0NS. Principal Office: 147 Frimley Road, Camberley, Surrey, GU15 2PS. Registered in England & Wales No.: 11220173.

The information contained within this website is subject to the UK regulatory regime and therefore restricted to consumers based in the UK.

The Financial Ombudsman Service is available to sort out individual complaints that clients and financial services business aren’t able to resolve themselves. To contact the Financial Ombudsman Service, please visit www.financial-ombudsman.org.uk.

Recent Comments