In this blog post, we’ll explore what the potential implications are for personal financial planning as flood damage costs continue to rise in the UK.

Succession Planning

Written by

Should you be succession planning?

Your business might be relatively new, but you should still be thinking about succession planning. It’s something that often gets left until the last minute – or isn’t done at all – and that can have a significant impact not just on the ongoing success of your business, but also on your family’s personal financial situation.

What is succession planning?

It’s basically a safety net for you, your business and the people who rely on it. Succession planning is often just thought of as ‘who takes over when I retire’ but there are other reasons why your role might need filling. The two most obvious are ill health or death. Neither are tempting subjects, but both could happen at any time – and everyone needs to be prepared for the possibility.

Why is it important?

Your business almost certainly ticks along nicely from day to day. Everyone has their position and role, and they rely on you for leadership, strategy, planning and consistency. It’s amazing how quickly this seemingly ordered existence can fall apart if you are no longer there to steer things. Other relationships in the business may be strained; people who think they should take over the business might be thwarted; and if you’re running a family business, personal relationships can easily get in the way.

That’s why it’s important to take the time to think seriously about what plans and processes would kick in with your business if you were to be incapacitated, take early retirement or need to leave the business for any other reason.

Taking the time to get it right

Your succession plan will depend on whether you are running a family business or a stand-alone business. You might also have to make different plans if you are in a partnership rather than a Limited business. That’s why it’s a good idea to get some independent advice. There are some key things to think about, whatever type of business you run:

- Get started as soon as possible – the longer you leave it, the more tricky a succession plan may become. Even if you have only recently started your business, it’s worth thinking about your succession plan. It will help to keep your business running.

- Include key people in the business – there should be no such thing as a secret succession plan. For a family business, talk to the relevant people to be clear about what you want to achieve and sort out who is able or willing to work with you to achieve those goals. And even if it’s not a family business – you will need to bring the right people along with you as you plan.

- Think about what you want – if you are planning for early retirement, for example, do you still want to be able to take an income out of the business?

- Have a robust business plan in place – apart from planning early retirement, you’re unlikely to know exactly when your succession plan will be needed. So you need to have a strong and practical business plan in place so that your business is in the best possible position at all times.

It can take a while to sort out a good succession plan. There are many variables to take into account, many people to involve and a potential range of business processes to put into place. At Switchfoot Wealth, we’ll work with your accountant and other advisers to make sure that your personal financial needs and wants are reflected in your succession planning, giving you peace of mind for yourself and your family.

“

I started Switchfoot Wealth to offer financial planning that matches the way we live and work today. Using the best technology and offering expertise gained through both formal qualifications and years of working closely with clients, we are bringing financial planning into the 21st century, helping people, businesses and professional advisers make the most of their time and their money.

– Sebastian Ewell

Switchfoot Wealth Founder

Read more about Switchfoot Wealth

Related Articles

The Rising Cost of Flood Damage in the UK: What it Means for Your Personal Financial Planning

Webinar for home care providers

We welcome SOLLA Affiliate member Claire Edwards of Claire Edwards Eldercare for a presentation designed for home care providers. We discuss the benefits of SOLLA and being a SOLLA Affiliate and also discuss how to support people with continuing health care funding...

Mind the Gap

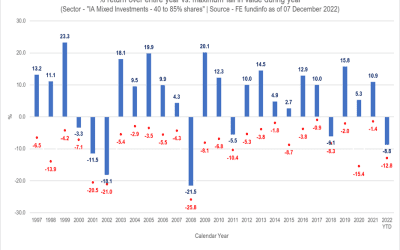

Mind the Gap “My investments have reduced in value”. In 2022, this has been one of the main reasons that new clients have shared as to why they are now seeking financial advice. No-one relishes seeing red when logging in to see their investments. However, it’s...

SwitchFoot Wealth Limited is an appointed representative of Sense Network Limited which is authorised and regulated by the Financial Conduct Authority. SwitchFoot Wealth Limited is entered on the Financial Services register (www.fca.org.uk/register) under reference number 808196.

Registered Address: 28 Upper Hale Road, Farnham, Surrey, GU9 0NS. Principal Office: 147 Frimley Road, Camberley, Surrey, GU15 2PS. Registered in England & Wales No.: 11220173.

The information contained within this website is subject to the UK regulatory regime and therefore restricted to consumers based in the UK.

The Financial Ombudsman Service is available to sort out individual complaints that clients and financial services business aren’t able to resolve themselves. To contact the Financial Ombudsman Service, please visit www.financial-ombudsman.org.uk.

Recent Comments