In this blog post, we’ll explore what the potential implications are for personal financial planning as flood damage costs continue to rise in the UK.

Helping solicitors and deputies manage complex financial arrangements

Written by

If you have been appointed as an attorney or a deputy, you have a duty of care to manage your client’s financial arrangements to the benefit of either the client themselves or the beneficiaries of any trust, depending on circumstances.

When your client’s financial arrangements are complicated, managing them can take a significant amount of time. You need to be aware of the full range of current investments, including any savings, trusts, share ownership, property, business assets and pension schemes. You will also need to be able to review those investments and assets to make sure that they are benefitting your client and are able to fund long-term plans such as full-time nursing care.

You will also need to make sure that any other attorneys involved with your client’s case – who are often family or friends – are behaving appropriately, and have the tools in place to spot any attempts to defraud your client. That means having a good overview of all accounts – particularly cash accounts such as current accounts or savings accounts – so that you are aware of any unusual spending or transactions.

How could we help?

All this mounts up to a significant responsibility for practising solicitors, accountants or other professional advisers. So how can a financial adviser help you?

Independent assessment of current plans and investments – a qualified and regulated independent financial adviser can review current arrangements, including the fees paid, to see whether your client is getting the best value for money. In fact, you can start this process straight away by using our free calculator.

Help you ask the right questions – understanding how different investment vehicles work allows you to ask key questions of your current investment advisers so that you can be sure your client’s money is being properly invested and is producing the best returns.

Review financial plans – your client’s current financial investments may not be suitable for their current situation or their future plans. It’s particularly important to consider your client’s cash flow, and whether it is appropriate for their needs. By reviewing financial plans, you could make your client’s portfolio less complex, or be able to make a clearer plan for the future.

Access the full market –existing finances and investments should be reviewed by comparison to all reasonable options. By working with an independent financial adviser, you can access the full investment market on your client’s behalf, which may give you access to better products and opportunities.

If you are currently managing complex financial arrangements for clients, feel free to call us to see how we could help you review what’s in place. Our free calculator and meeting guide gives you advice on the sort of questions you can ask of existing investment advisers, and you can also choose to ask us to run a specific appraisal report for your client’s current finances.

For Professional Fiduciaries. Not aimed at retail clients.

I started Switchfoot Wealth to offer financial planning that matches the way we live and work today. Using the best technology and offering expertise gained through both formal qualifications and years of working closely with clients, we are bringing financial planning into the 21st century, helping people, businesses and professional advisers make the most of their time and their money.

– Sebastian Ewell

Switchfoot Wealth Founder

Read more about Switchfoot Wealth

Related Articles

The Rising Cost of Flood Damage in the UK: What it Means for Your Personal Financial Planning

Webinar for home care providers

We welcome SOLLA Affiliate member Claire Edwards of Claire Edwards Eldercare for a presentation designed for home care providers. We discuss the benefits of SOLLA and being a SOLLA Affiliate and also discuss how to support people with continuing health care funding...

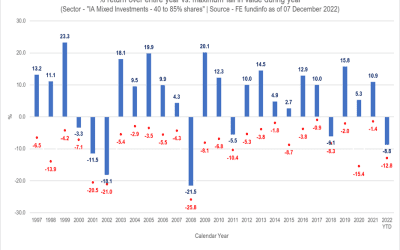

Mind the Gap

Mind the Gap “My investments have reduced in value”. In 2022, this has been one of the main reasons that new clients have shared as to why they are now seeking financial advice. No-one relishes seeing red when logging in to see their investments. However, it’s...

SwitchFoot Wealth Limited is an appointed representative of Sense Network Limited which is authorised and regulated by the Financial Conduct Authority. SwitchFoot Wealth Limited is entered on the Financial Services register (www.fca.org.uk/register) under reference number 808196.

Registered Address: 28 Upper Hale Road, Farnham, Surrey, GU9 0NS. Principal Office: 147 Frimley Road, Camberley, Surrey, GU15 2PS. Registered in England & Wales No.: 11220173.

The information contained within this website is subject to the UK regulatory regime and therefore restricted to consumers based in the UK.

The Financial Ombudsman Service is available to sort out individual complaints that clients and financial services business aren’t able to resolve themselves. To contact the Financial Ombudsman Service, please visit www.financial-ombudsman.org.uk.

Recent Comments