Written by Steve Day

March 4, 2024

Green Bank, Green Pension?

Kudos to Make My Money Matter (again!) for their ranking of how green UK pension providers are. It’s a welcome insight into the ethics, policies, and intentions of these companies.

Similar comparisons of banks have been around for a while, with https://bank.green/ being an excellent example of this.

However, it’s important to be aware of the differences that exist between choosing a green bank and choosing a green pension.

When you have money in your bank accounts, it will be the policies of the bank itself that determines how that money will be used by them. So, you can have peace of mind that having an account with a “green” bank will mean that your money isn’t been used for loans to fossil fuel companies or similar.

A pension is different.

Yes, it’s important to consider the credentials of the provider itself.

However, it’s the funds that you invest in where the true impact occurs. Holding an unsustainable fund with a high-ranking provider won’t be as positive as holding a sustainable fund with a low-ranking one.

Think of it like a supermarket.

You probably shop with a company that has ethics, policies, and intentions that you’re comfortable with. But if you choose to buy products from them that contradict this, then you’ve not had the impact you’d intended.

So do make sure that your pension provider is one with whom you’re comfortable.

More importantly, make sure that the funds that you have within your pension are aligned with your expectations.

Don’t know where to start? Here are a few tips:

- Investigate Your Current Investments: Start by finding out what funds your pension is currently invested in. Your pension provider’s regular valuations or online access should provide this information. Look for the fund factsheet, which outlines objectives and may include a breakdown of the top 10 holdings.

(Tip: Use codes like SEDOL or ISIN for easier online searches. If a direct link to the fund factsheet isn’t provided, use search engines like Ecosia for assistance.)

- Use MSCI for Greater Insight: Gain a second opinion on your fund’s sustainability by utilising MSCI, a global provider of portfolio analysis. Enter your fund details on their ESG Fund Ratings and Climate Search Tool to access information on temperature alignment, carbon intensity, fossil fuel revenues, and more (https://www.msci.com/our-solutions/esg-investing/esg-fund-ratings-climate-search-tool)

Assess Your Satisfaction with Current Investments: If you find your current fund(s) align well with your sustainability criteria, that’s excellent news. However, if changes are needed, explore alternative funds offered by your pension provider. You’ll find information on what these are either on your documentation, online, or by giving them a call.

Seek Financial Advice with a Sustainability Lens: If you feel overwhelmed, seeking financial advice is a valid option. However, it’s crucial to choose a firm with strong sustainability credentials. Check their website for details on impact, independent accreditations, and other relevant information before engaging with them.

*All investments carry risk and past performance is no guarantee of future returns. Our fossil-fuelled past is very unrepresentative of the future we need to build and adapt to. The timing and speed of our transition to a new economy makes short to medium term returns more uncertain.

Steve Day

Independent Financial Adviser

I started Switchfoot Wealth to offer financial planning that matches the way we live and work today. Using the best technology and offering expertise gained through both formal qualifications and years of working closely with clients, we are bringing financial planning into the 21st century, helping people, businesses and professional advisers make the most of their time and their money.

– Sebastian Ewell

Switchfoot Wealth Founder

Read more about Switchfoot Wealth

Related Articles

Webinar for home care providers

We welcome SOLLA Affiliate member Claire Edwards of Claire Edwards Eldercare for a presentation designed for home care providers. We discuss the benefits of SOLLA and being a SOLLA Affiliate and also discuss how to support people with continuing health care funding...

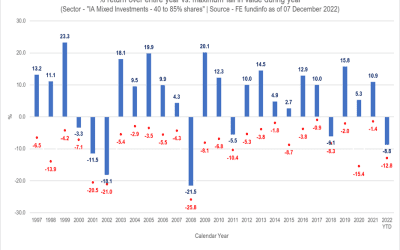

Mind the Gap

Mind the Gap “My investments have reduced in value”. In 2022, this has been one of the main reasons that new clients have shared as to why they are now seeking financial advice. No-one relishes seeing red when logging in to see their investments. However, it’s...

Caring for the Carers

If the health and well-being of the carer deteriorates, then what happens to be person being cared for?

SwitchFoot Wealth Limited is an appointed representative of Sense Network Limited which is authorised and regulated by the Financial Conduct Authority. SwitchFoot Wealth Limited is entered on the Financial Services register (www.fca.org.uk/register) under reference number 808196.

Registered Address: 28 Upper Hale Road, Farnham, Surrey, GU9 0NS. Principal Office: 147 Frimley Road, Camberley, Surrey, GU15 2PS. Registered in England & Wales No.: 11220173.

The information contained within this website is subject to the UK regulatory regime and therefore restricted to consumers based in the UK.

The Financial Ombudsman Service is available to sort out individual complaints that clients and financial services business aren’t able to resolve themselves. To contact the Financial Ombudsman Service, please visit www.financial-ombudsman.org.uk.