In this blog post, we’ll explore what the potential implications are for personal financial planning as flood damage costs continue to rise in the UK.

Mind the Gap

Written by

Mind the Gap

“My investments have reduced in value”.

In 2022, this has been one of the main reasons that new clients have shared as to why they are now seeking financial advice.

No-one relishes seeing red when logging in to see their investments.

However, it’s important to see this in the context of a long-term financial plan.

Markets go down and up, and not necessarily in that order.

How one behaves in such circumstances is key. We spend a lot of time educating and informing clients to help ensure that decisions aren’t taken that will have long-term negative consequences.

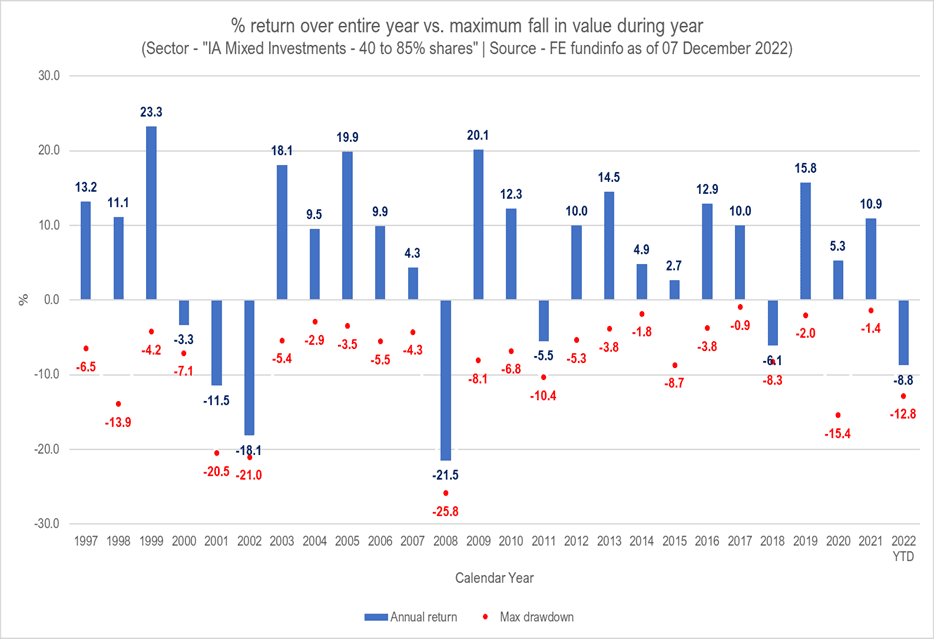

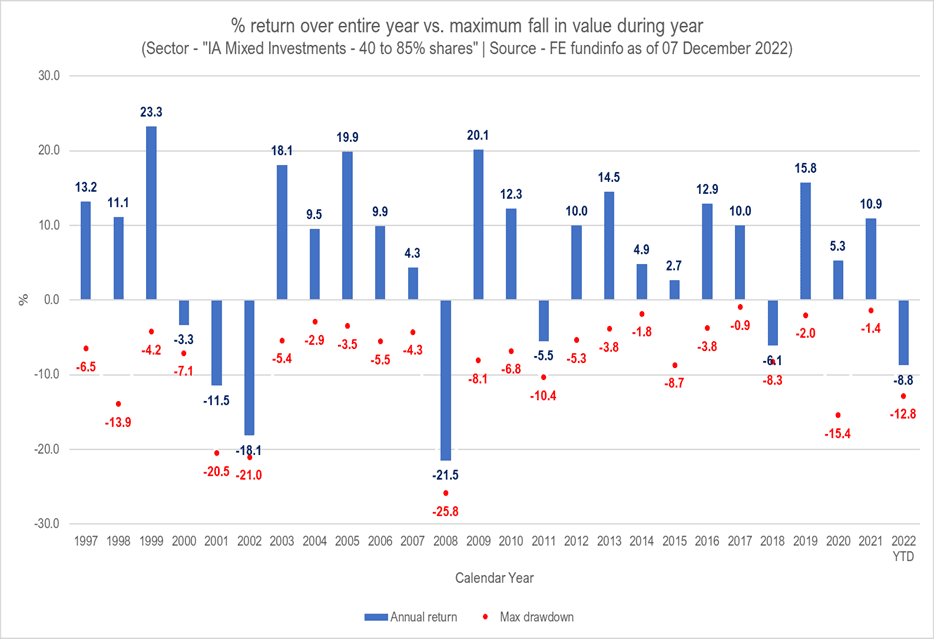

The above chart is a good way to illustrate this.

This details the maximum fall during the year (red dots) and the overall change in the entire year (blue bars) across a mixed investment of mainly equities and fixed interest assets (e.g. bonds).

What it shows is that in every year of the past 25, the year has ended with the portfolio in a better relative position to its lowest point.

In 2020, the portfolio fell by 15.4% during the early stage of COVID but recovered to end the year up by 5.3%.

During the financial crisis of 2008, the portfolio ended the year down 21.5% but this was still higher than the low point of 25.8% reduction.

And now we’re seeing the same in 2022. The lowest point reached so far this year was 12.8% down but we’re on track to end the year around 8.8% down.

What’s the takeaway from this?

Resist the temptation to react and “cash-out” at the bottom of the market.

History shows that portfolios recover, often in the same year and then in the years after.

Minding this gap may well be what enables success in your long-term financial plan.

Please note: Investments carry risk. The value of your investment (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

Steve Day

Independent Financial Adviser

I started Switchfoot Wealth to offer financial planning that matches the way we live and work today. Using the best technology and offering expertise gained through both formal qualifications and years of working closely with clients, we are bringing financial planning into the 21st century, helping people, businesses and professional advisers make the most of their time and their money.

– Sebastian Ewell

Switchfoot Wealth Founder

Read more about Switchfoot Wealth

Related Articles

The Rising Cost of Flood Damage in the UK: What it Means for Your Personal Financial Planning

Webinar for home care providers

We welcome SOLLA Affiliate member Claire Edwards of Claire Edwards Eldercare for a presentation designed for home care providers. We discuss the benefits of SOLLA and being a SOLLA Affiliate and also discuss how to support people with continuing health care funding...

Mind the Gap

Mind the Gap “My investments have reduced in value”. In 2022, this has been one of the main reasons that new clients have shared as to why they are now seeking financial advice. No-one relishes seeing red when logging in to see their investments. However, it’s...

SwitchFoot Wealth Limited is an appointed representative of Sense Network Limited which is authorised and regulated by the Financial Conduct Authority. SwitchFoot Wealth Limited is entered on the Financial Services register (www.fca.org.uk/register) under reference number 808196.

Registered Address: 28 Upper Hale Road, Farnham, Surrey, GU9 0NS. Principal Office: 147 Frimley Road, Camberley, Surrey, GU15 2PS. Registered in England & Wales No.: 11220173.

The information contained within this website is subject to the UK regulatory regime and therefore restricted to consumers based in the UK.

The Financial Ombudsman Service is available to sort out individual complaints that clients and financial services business aren’t able to resolve themselves. To contact the Financial Ombudsman Service, please visit www.financial-ombudsman.org.uk.

Recent Comments