Have you got a Financial Freedom plan?

When we speak to business owners about their long-term goals, we often hear the words ‘financial freedom’. Whether that’s paying off the mortgage, having enough pension and investments for early retirement, or being able to fulfil travel and leisure plans, these business owners all have one thing in common: they need the business to provide the funds.

It’s never too early to start planning

We’re firm believers in starting early. That’s because the sooner you start to make a financial plan that includes your business, the more likely you are to realise it. Many people spend their mid-working life devoting hours and hours to their businesses. What you really need is for your business to be devoting pounds and pounds to your bank account.

What is it that you want to achieve?

- Buy your family’s forever home

- Be mortgage free by a certain point

- Take a sabbatical to travel, study or work on another business

- Undertake a new build or significant renovation project while your business works for you

- Make more tax-efficient savings and investment plans

How a financial plan can help

For business owners, a personal financial plan should also underpin any business decisions you make. After all, it’s your business that’s going to provide the financial freedom you need. So the two things will always work hand-in-hand, and that means you can take big strides in the growth and management of your business.

A plan will help you see how you can build your business to increase your income, build value for your exit strategy and use the proceeds to give yourself the lifestyle you really want. You can continue to work, of course, but you don’t have to – it’s a choice rather than a necessity.

Protecting yourself and your family

Owning a business is risky – as we’ve seen recently, it doesn’t matter how huge your business is, it can still go to the wall if it meets the wrong set of circumstances. So it makes sense to protect you, your shareholders and your family. Can your business run without you? Who would take over if you had to step aside? How would you meet your financial commitments or your lifestyle goals?

All these things are genuinely important, and too many business owners keep putting discussions to the bottom of the pile. But working on a wider financial plan means you will have the confidence to make key decisions about your business and your personal life. It means you’ll have a clear idea of what comes next and what you need to do. And it means you will be in control, with the backing of independent financial expertise behind you.

So, is this valuable to you?

If you think it would be valuable to create a road-map so that your business is working hard to support your personal financial goals, why not talk to us today? We can start to build your own personal financial plan and we’ll be with you every step of the way.

I started Switchfoot Wealth to offer financial planning that matches the way we live and work today. Using the best technology and offering expertise gained through both formal qualifications and years of working closely with clients, we are bringing financial planning into the 21st century, helping people, businesses and professional advisers make the most of their time and their money.

– Sebastian Ewell

Switchfoot Wealth Founder

Read more about Switchfoot Wealth

Related Articles

The Rising Cost of Flood Damage in the UK: What it Means for Your Personal Financial Planning

In this blog post, we’ll explore what the potential implications are for personal financial planning as flood damage costs continue to rise in the UK.

Webinar for home care providers

We welcome SOLLA Affiliate member Claire Edwards of Claire Edwards Eldercare for a presentation designed for home care providers. We discuss the benefits of SOLLA and being a SOLLA Affiliate and also discuss how to support people with continuing health care funding...

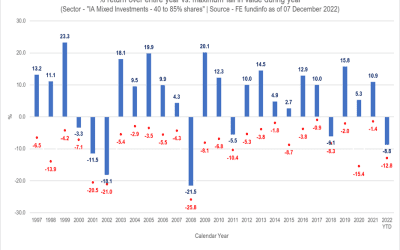

Mind the Gap

Mind the Gap “My investments have reduced in value”. In 2022, this has been one of the main reasons that new clients have shared as to why they are now seeking financial advice. No-one relishes seeing red when logging in to see their investments. However, it’s...

SwitchFoot Wealth Limited is an appointed representative of Sense Network Limited which is authorised and regulated by the Financial Conduct Authority. SwitchFoot Wealth Limited is entered on the Financial Services register (www.fca.org.uk/register) under reference number 808196.

Registered Address: 28 Upper Hale Road, Farnham, Surrey, GU9 0NS. Principal Office: 147 Frimley Road, Camberley, Surrey, GU15 2PS. Registered in England & Wales No.: 11220173.

The information contained within this website is subject to the UK regulatory regime and therefore restricted to consumers based in the UK.

The Financial Ombudsman Service is available to sort out individual complaints that clients and financial services business aren’t able to resolve themselves. To contact the Financial Ombudsman Service, please visit www.financial-ombudsman.org.uk.