This blog was first published by Lawskills and has been replicated in part here, the original article is available on the following link

https://www.lawskills.co.uk/articles/2019/05/attorneys-safeguarding-duties-help/

Are you meeting your safeguarding duties?

In December 2018, high street bank Santander was fined nearly £33m for failing to pass on the assets of deceased customers to their personal representatives and beneficiaries. In some cases, said the Financial Conduct Authority, the bank failed to realise that the deceased customer had multiple accounts. So if the beneficiaries and representatives were also unaware, the money was never released by the bank.

A separate case, re: MM, highlights the potential difficulties of a situation where two attorneys, appointed jointly and severally – one of whom is a solicitor. In theory, this is a sensible arrangement; there is both an attorney with a personal connection to the individual, and an attorney who understands the relevant legal responsibilities and constraints and can ensure that the attorneyship is correctly managed.

In the case of MM, however, financial abuse occurred, and that abuse would have been noticed sooner had the professional attorney sought access to financial statements, or had established a better understanding of the relationships of the donor and her family, only one of which had been appointed as attorney.

Talking about the law as it applied to this case, District Judge Batten referred to paragraph 7.59 of the Code of Practice to the MCA 2005, which states:

“Duty of care’ means applying a certain standard of care and skill – depending on whether the attorney is paid for their services or holds relevant professional qualifications…. If attorneys are being paid for their services, they should demonstrate a higher degree of care & skill. Attorneys who undertake their duties in the course of their professional work (such as solicitors….) must display professional competence and follow their profession’s rules and standards.”

The Judge ruled that the Property and Financial Affairs LPA should be wholly revoked and a panel Deputy appointed. The solicitor was responsible for their own costs incurred by the case, and jointly responsible for the Official Solicitor’s costs and any other reasonable costs arising.

The importance of safeguarding

Both these cases show a need for all attorneys to have clear, real-time oversight over the individuals’ financial matters, and the case of MM shows how important it is for professional attorneys to not only understand the law, but apply it strictly and in the individual’s interests. Attorneys cannot simply add the individual to a long list of clients and hope that everything goes smoothly. Attorneyships are often made and used in times of stress and can bring significant complications. It is the duty of a professional attorney to do everything they can to administer an estate wholly in the interests of an individual and to guide any other attorneys accordingly.

Partnering with Switchfoot Teams

Switchfoot Wealth has partnered with Switchfoot Teams to provide access to the Switchfoot Teams portal which has been developed to meet the needs of attorneys, deputies and trustees.

To find out more, contact us today.

“

I started Switchfoot Wealth to offer financial planning that matches the way we live and work today. Using the best technology and offering expertise gained through both formal qualifications and years of working closely with clients, we are bringing financial planning into the 21st century, helping people, businesses and professional advisers make the most of their time and their money.

– Sebastian Ewell

Switchfoot Wealth Founder

Read more about Switchfoot Wealth

Related Articles

The Rising Cost of Flood Damage in the UK: What it Means for Your Personal Financial Planning

In this blog post, we’ll explore what the potential implications are for personal financial planning as flood damage costs continue to rise in the UK.

Webinar for home care providers

We welcome SOLLA Affiliate member Claire Edwards of Claire Edwards Eldercare for a presentation designed for home care providers. We discuss the benefits of SOLLA and being a SOLLA Affiliate and also discuss how to support people with continuing health care funding...

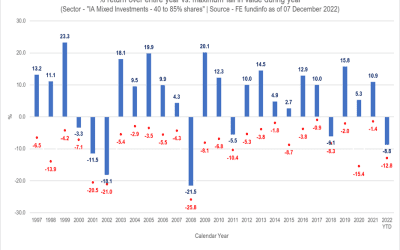

Mind the Gap

Mind the Gap “My investments have reduced in value”. In 2022, this has been one of the main reasons that new clients have shared as to why they are now seeking financial advice. No-one relishes seeing red when logging in to see their investments. However, it’s...

SwitchFoot Wealth Limited is an appointed representative of Sense Network Limited which is authorised and regulated by the Financial Conduct Authority. SwitchFoot Wealth Limited is entered on the Financial Services register (www.fca.org.uk/register) under reference number 808196.

Registered Address: 28 Upper Hale Road, Farnham, Surrey, GU9 0NS. Principal Office: 147 Frimley Road, Camberley, Surrey, GU15 2PS. Registered in England & Wales No.: 11220173.

The information contained within this website is subject to the UK regulatory regime and therefore restricted to consumers based in the UK.

The Financial Ombudsman Service is available to sort out individual complaints that clients and financial services business aren’t able to resolve themselves. To contact the Financial Ombudsman Service, please visit www.financial-ombudsman.org.uk.