Financial Planning for Trusts – Should beneficiaries be insured?

Investing for growth on behalf of trust beneficiaries is a considerable responsibility. Each individual trust has its own purpose, and trustees should be planning and investing to meet that purpose. In order to do that, they must have a clear idea not just of the potential ‘end-point’ of the trust, but also of the various scenarios that could occur during the life of the trust.

That’s why our free investment calculator is so invaluable. By filling in a simple form, you can access some guidance on the types of questions you should be asking when you meet your investment managers, helping you to learn more about the key points and situations that might influence your investment decisions. It includes benchmark fees and costs for a range of potential investment strategies, and it’s the ideal reference guide to help you ask the right questions.

Our tool is particularly useful for prompting you to asking those all-important ‘what if’ questions – something that many investment managers don’t cover.

How do scenarios help trustee planning?

For example, we had clients who were orphaned before the age of 21. Their parents’ estates were left in a discretionary will trust for them. The trustees were investing “for growth”, so we used cash flow modelling to imagine scenarios where the trustees might need to pay out significant trust funds earlier than intended.

In this example, if either of the beneficiaries were unable to work through illness or accident, then the trustees would have a moral obligation to support them. This would, in turn, have a significant negative impact on the trust funds, which are intended to provide financial security throughout our clients’ lives and, when the time was right, to help them onto the property ladder.

A simple solution

Because the beneficiaries were young fit and healthy, despite a family history of morbidity and indeed early mortality in close relatives in middle age, the cost of putting in place long-term income protection insurance was only around £20 per month per client. For a trust with assets in excess of £500,000 this represented a negligible drag on investment returns, and removed a risk to the trust, protecting the beneficiaries for their working lives as intended.

We made a personal recommendation to the beneficiaries for a simple long-term income protection plan, which had guaranteed insurability options so that cover could be increased in future years as their earnings grew over time. The trustees paid a small income to the beneficiaries to cover the cost of the insurance.

A ’whole’ solution

If you’re involved in making investment decisions of any type – as a trustee, an attorney or professional deputy, it’s very important to take the widest possible view in order to feel confident you are making informed decisions. What trustees need is reliable, independent financial planning that looks at the bigger picture, challenges assumptions and looks for alternative ways to achieve the end goals that are as efficient and as effective as possible.

You can find out more about our investment calculator, free meeting guide and how we work on our website.

Please note: This blog is for general information only and does not constitute advice. The information is aimed at professional fiduciaries and not retail clients only.

The Financial Conduct Authority does not regulate trust advice. Your capital is at risk. The value of your investment (and any income from them) can go down as well as up and you may not get back the full amount you invested. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

“

I started Switchfoot Wealth to offer financial planning that matches the way we live and work today. Using the best technology and offering expertise gained through both formal qualifications and years of working closely with clients, we are bringing financial planning into the 21st century, helping people, businesses and professional advisers make the most of their time and their money.

– Sebastian Ewell

Switchfoot Wealth Founder

Read more about Switchfoot Wealth

Related Articles

The Rising Cost of Flood Damage in the UK: What it Means for Your Personal Financial Planning

In this blog post, we’ll explore what the potential implications are for personal financial planning as flood damage costs continue to rise in the UK.

Webinar for home care providers

We welcome SOLLA Affiliate member Claire Edwards of Claire Edwards Eldercare for a presentation designed for home care providers. We discuss the benefits of SOLLA and being a SOLLA Affiliate and also discuss how to support people with continuing health care funding...

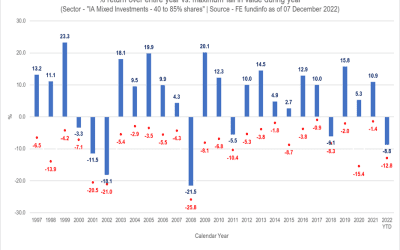

Mind the Gap

Mind the Gap “My investments have reduced in value”. In 2022, this has been one of the main reasons that new clients have shared as to why they are now seeking financial advice. No-one relishes seeing red when logging in to see their investments. However, it’s...

SwitchFoot Wealth Limited is an appointed representative of Sense Network Limited which is authorised and regulated by the Financial Conduct Authority. SwitchFoot Wealth Limited is entered on the Financial Services register (www.fca.org.uk/register) under reference number 808196.

Registered Address: 28 Upper Hale Road, Farnham, Surrey, GU9 0NS. Principal Office: 147 Frimley Road, Camberley, Surrey, GU15 2PS. Registered in England & Wales No.: 11220173.

The information contained within this website is subject to the UK regulatory regime and therefore restricted to consumers based in the UK.

The Financial Ombudsman Service is available to sort out individual complaints that clients and financial services business aren’t able to resolve themselves. To contact the Financial Ombudsman Service, please visit www.financial-ombudsman.org.uk.