7 reasons why we’re Transparency Task Force members

You may have seen or heard us talk about working with the Transparency Task Force (TTF). This is important to us as a team because it’s work we do on a voluntary basis and it’s helping to protect vulnerable people when they need reliable financial help. In fact, from our office in Farnham, we’re part of an international group of ambassadors who have spent their careers pursuing better and more ethical ways of working.

So we thought we’d share the 7 top reasons why we’ve chosen to stand up for transparency and clarity in the financial services sector.

- It’s a not-for-profit organisation that shares our values – our leading value is all about doing business ethically. That means treating people with respect, offering honest, clear and useful advice and going the extra mile to protect our clients.

- It operates on a volunteer basis, so we know our TTF colleagues have the best motives – there are currently more than 2.600 finance professionals giving their time to help the TTF have an impact across the sector. This gives us hope that there is an increasing number of people who want to see changes in the industry and are prepared to stand up and make those changes happen.

- It gives us the opportunity to share our expertise – our founder, Sebastian Elwell specialises in later life and succession planning and has built up a range of expertise and knowledge that he can share with others in an environment where it can start to make a difference.

- It believes in the power and will of the financial sector to do good – the finance and banking industries do not have a great reputation among the general public. Yet there are thousands of qualified, ethical and trustworthy advisers and professionals in the UK who just want to do a good job for their clients. Taking part in the TTF demonstrates our commitment to the industry and our belief that it is a force for good.

- It believes in changing the conversation to being about the individual, not the industry – for financial advisers like Sebastian, nothing is more important than the client. By focusing on a wide range of long-term issues in the sector, the TTF is hoping to show that the individual investor should be at the heart of everything we do.

- It’s helping us to lead the drive to ensure vulnerable people get the best advice – Sebastian leads the team investigating ways to improve the transparency and oversight of Lasting Power of Attorney (LPA) documents. This will help to protect vulnerable people who are no longer able to manage their own finances.

- It allows us to get to know other leaders in the ethically-aware financial sector – we are keen to build a network of like-minded financial professionals, whether they are financial advisers or work within banks, funds and other financial management institutions.

You can click to find out more about the Transparency Task Force, or contact us today to find out more about how we help individuals plan their financial futures, or manage investments and savings for vulnerable family members.

“

I started Switchfoot Wealth to offer financial planning that matches the way we live and work today. Using the best technology and offering expertise gained through both formal qualifications and years of working closely with clients, we are bringing financial planning into the 21st century, helping people, businesses and professional advisers make the most of their time and their money.

– Sebastian Ewell

Switchfoot Wealth Founder

Read more about Switchfoot Wealth

Related Articles

The Rising Cost of Flood Damage in the UK: What it Means for Your Personal Financial Planning

In this blog post, we’ll explore what the potential implications are for personal financial planning as flood damage costs continue to rise in the UK.

Webinar for home care providers

We welcome SOLLA Affiliate member Claire Edwards of Claire Edwards Eldercare for a presentation designed for home care providers. We discuss the benefits of SOLLA and being a SOLLA Affiliate and also discuss how to support people with continuing health care funding...

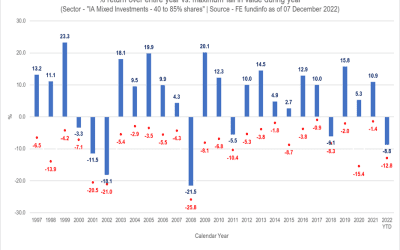

Mind the Gap

Mind the Gap “My investments have reduced in value”. In 2022, this has been one of the main reasons that new clients have shared as to why they are now seeking financial advice. No-one relishes seeing red when logging in to see their investments. However, it’s...

SwitchFoot Wealth Limited is an appointed representative of Sense Network Limited which is authorised and regulated by the Financial Conduct Authority. SwitchFoot Wealth Limited is entered on the Financial Services register (www.fca.org.uk/register) under reference number 808196.

Registered Address: 28 Upper Hale Road, Farnham, Surrey, GU9 0NS. Principal Office: 147 Frimley Road, Camberley, Surrey, GU15 2PS. Registered in England & Wales No.: 11220173.

The information contained within this website is subject to the UK regulatory regime and therefore restricted to consumers based in the UK.

The Financial Ombudsman Service is available to sort out individual complaints that clients and financial services business aren’t able to resolve themselves. To contact the Financial Ombudsman Service, please visit www.financial-ombudsman.org.uk.