Introducing the Personal Finance Society

As we celebrate our founder, Sebastian Elwell, being announced as the winner of the Personal Finance Society’s 2020 award for Retirement and Later Life Specialist of the Year, we thought this would be a great opportunity to shine a spotlight on what the Society is for.

Part of the Chartered Insurance Institute Group, the Personal Finance Society was established to give the public more confidence and trust in the personal financial advice profession.

It does this by making sure that its members meet strict standards of professionalism and governance, and that they comply with the Society’s Code of Ethics. This Code stipulates that all financial advisers should act in the best interests of each client, provide a high standard of service and treat people fairly.

Bringing finances to life

One of the key things about the Personal Finance Society is the initiatives it supports. Recently these have included financial wellbeing television programmes, a schools outreach programme called My Personal Finance Skills, a Forces MoneyPlan scheme, which offers free financial guidance to armed forces personnel and veterans, and a Find an Advisor tool, which gives individuals access to more than 20,000 qualified financial advisers.

In addition, the Society runs an e-mentor programme, and Sebastian also volunteers as a mentor with the programme, supporting, guiding and developing the next generation of financial planners and paraplanners.

Does my adviser need Personal Finance Society membership?

There’s no legal required for your financial adviser to be a member of the Personal Finance Society. However, it is a requirement to be a member of a professional body which can issue the adviser with a Statement of Professional Standing, which is reviewed every year. We have chosen to be a member of the Personal Finance Society because it is the largest of all the professional bodies in the UK for financial advisers.

As with all professions, membership of the PFS and other key bodies should give you confidence in your adviser’s qualifications, expertise and experience. Sebastian Elwell is also a member of STEP and SOLLA – all highly regarded organisations with strict membership criteria. So for people looking for financial advice in Farnham, these memberships and qualifications give additional peace of mind.

We would always recommend that you take your time when choosing a financial adviser. Look for:

- An independent adviser who is not tied to any particular products or providers, and who can give you advice that covers the whole of the market.

- Someone with expertise in the areas you’re interested in – for example, later life advice, inheritance and succession planning or wider family financial advice.

- Someone with recognised qualifications, such as a Chartered Financial Planner, an Advanced Diploma in Financial Planning and relevant memberships of bodies that promote professional standards.

You can visit the Personal Finance Society’s website, or contact us today to find out more about how we work and how we can help support your financial planning.

“

I started Switchfoot Wealth to offer financial planning that matches the way we live and work today. Using the best technology and offering expertise gained through both formal qualifications and years of working closely with clients, we are bringing financial planning into the 21st century, helping people, businesses and professional advisers make the most of their time and their money.

– Sebastian Ewell

Switchfoot Wealth Founder

Read more about Switchfoot Wealth

Related Articles

The Rising Cost of Flood Damage in the UK: What it Means for Your Personal Financial Planning

In this blog post, we’ll explore what the potential implications are for personal financial planning as flood damage costs continue to rise in the UK.

Webinar for home care providers

We welcome SOLLA Affiliate member Claire Edwards of Claire Edwards Eldercare for a presentation designed for home care providers. We discuss the benefits of SOLLA and being a SOLLA Affiliate and also discuss how to support people with continuing health care funding...

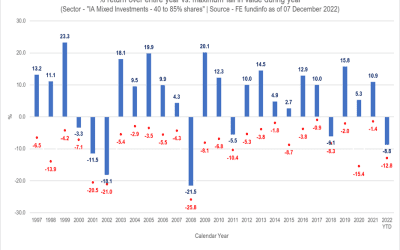

Mind the Gap

Mind the Gap “My investments have reduced in value”. In 2022, this has been one of the main reasons that new clients have shared as to why they are now seeking financial advice. No-one relishes seeing red when logging in to see their investments. However, it’s...

SwitchFoot Wealth Limited is an appointed representative of Sense Network Limited which is authorised and regulated by the Financial Conduct Authority. SwitchFoot Wealth Limited is entered on the Financial Services register (www.fca.org.uk/register) under reference number 808196.

Registered Address: 28 Upper Hale Road, Farnham, Surrey, GU9 0NS. Principal Office: 147 Frimley Road, Camberley, Surrey, GU15 2PS. Registered in England & Wales No.: 11220173.

The information contained within this website is subject to the UK regulatory regime and therefore restricted to consumers based in the UK.

The Financial Ombudsman Service is available to sort out individual complaints that clients and financial services business aren’t able to resolve themselves. To contact the Financial Ombudsman Service, please visit www.financial-ombudsman.org.uk.