LPA Safeguarding in practice – when things go wrong – Part 3

This blog was first published by Lawskills and has been replicated here in part, the original article is available on the following link

https://www.lawskills.co.uk/articles/2019/12/lpa-safeguarding-problems/

LPA Safeguarding in practice – when things go wrong

In our last article, John Smith lost capacity and his Lasting Power of Attorney had been invoked. John had appointed his niece to manage his financial affairs, and his solicitor as his professional safeguarder to ensure that any transactions are in John’s interest and above board.

Now, we discover that John’s niece, is under financial pressure because she has significant gambling debts – both John and his solicitor were unaware that she had any gambling problems. She has been using John’s money to service her debts.

Because John appointed a safeguarder, and all the transaction information is transparent within Switchfoot Teams, John’s solicitor has identified some unexpected and unexplained withdrawals and payments from John’s account. The safeguarder raised their concern with the Office of Public Guardian and is able to produce a comprehensive report of John’s finances as evidence.

It is clear that John’s niece can no longer be trusted to manage his finances, so an application is made to the Court of Protection to revoke the LPA and appoint a deputy. The court then appoints a professional deputy from the panel to manage John’s finances from that point.

The Deputy’s Role

Often, when a court-appointed deputy takes over from an attorney under an LPA, they have to deal with poor paperwork, missing records and disorganised administration. John’s decision to use Switchfoot Teams, however, means that the deputy is in a much better position to get straight on with managing John’s affairs:

- Detailed records help in attempting to recover the lost assets from the previous attorney.

- The deputy can produce accounts, using Switchfoot Teams, to help complete the OPG deputy return.

- When making best interest decisions on John’s behalf, section 4(7) of the Mental Capacity Act 2005 and Chapter 5 of the code of practice sets out requirements for the deputy to consult with others. The ability to invite others into Switchfoot Teams, and control the sharing of information and documents, makes it easy for the deputy to consult.

Partnering with Switchfoot Teams

Switchfoot Wealth has partnered with Switchfoot Teams to provide access to the Switchfoot Teams portal which has been developed to meet the needs of attorneys, deputies and trustees.

To find out more, contact us today.

“

I started Switchfoot Wealth to offer financial planning that matches the way we live and work today. Using the best technology and offering expertise gained through both formal qualifications and years of working closely with clients, we are bringing financial planning into the 21st century, helping people, businesses and professional advisers make the most of their time and their money.

– Sebastian Ewell

Switchfoot Wealth Founder

Read more about Switchfoot Wealth

Related Articles

The Rising Cost of Flood Damage in the UK: What it Means for Your Personal Financial Planning

In this blog post, we’ll explore what the potential implications are for personal financial planning as flood damage costs continue to rise in the UK.

Webinar for home care providers

We welcome SOLLA Affiliate member Claire Edwards of Claire Edwards Eldercare for a presentation designed for home care providers. We discuss the benefits of SOLLA and being a SOLLA Affiliate and also discuss how to support people with continuing health care funding...

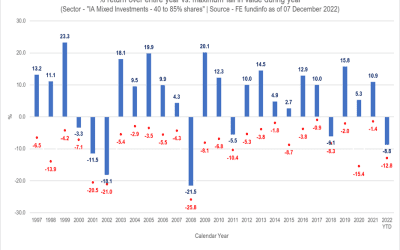

Mind the Gap

Mind the Gap “My investments have reduced in value”. In 2022, this has been one of the main reasons that new clients have shared as to why they are now seeking financial advice. No-one relishes seeing red when logging in to see their investments. However, it’s...

SwitchFoot Wealth Limited is an appointed representative of Sense Network Limited which is authorised and regulated by the Financial Conduct Authority. SwitchFoot Wealth Limited is entered on the Financial Services register (www.fca.org.uk/register) under reference number 808196.

Registered Address: 28 Upper Hale Road, Farnham, Surrey, GU9 0NS. Principal Office: 147 Frimley Road, Camberley, Surrey, GU15 2PS. Registered in England & Wales No.: 11220173.

The information contained within this website is subject to the UK regulatory regime and therefore restricted to consumers based in the UK.

The Financial Ombudsman Service is available to sort out individual complaints that clients and financial services business aren’t able to resolve themselves. To contact the Financial Ombudsman Service, please visit www.financial-ombudsman.org.uk.