LPA safeguarding in practice – a case study part 2

This blog was first published by Lawskills and has been replicated here, the original article is available on the following link

https://www.lawskills.co.uk/articles/2019/09/lpa-safeguarding-in-practice-a-case-study/

In our last article, we introduced you to John Smith. John had a complex estate and had decided to put a Lasting Power of Attorney in place so that someone he trusted could look after his finances and act in his best interests if he lost capacity.

Worried about the potential for financial abuse and fraud, however, John spoke both to his financial adviser and to his solicitor about how best to protect his finances. They suggested two things:

- To add a safeguarding clause that appointed a third party to oversee the activities of any attorneys; and

- To use real-time software that reflects any financial transactions and allows attorneys, safeguarders and other professionals to have an overview of John’s financial situation once he has lost capacity.

John accepted this advice and appointed his niece as his attorney, and a professional into a supervision role. He set up the software, added all his bank accounts and other financial information, and uploaded copies of his will, insurance policies and the LPA.

John invites his niece and solicitor into his ‘Team’ with a restricted online view into his wealth portal. John arranges an annual check in with his solicitor. Confident that he has put everything in place, John gets on with life.

Losing capacity – the attorney takes over

John has recently lost the capacity to manage his own finances, and now needs the help and support of his attorney. After the paperwork has been managed to confirm that his attorney can now act on his behalf. John’s niece was in regular touch before he lost capacity and knows what are his financial wishes. She now has access to all his bank and savings accounts, investments and pension funds and needs to manage them correctly in order to ensure that John remains in the best possible financial position whilst also being able to meet any costs associated with his standard of living and general care.

At this point, the supervision and safeguarding clauses that John added to his LPA are actioned. The professional appointed as safeguarder now has oversight of John’s accounts and will be able to see, in real time, if there are any unusual or unexpected transactions taking place. This is particularly applicable if, for example, John’s niece lives at a distance and John has a carer coming into the home. He may give the carer his bank card to buy sundries, and his niece and his safeguarder may be completely unaware that he has done this. But, by having oversight of the accounts, they can see if that card is being abused or used fraudulently and query it immediately with John, his carer and the agency supplying the carer.

John is able to retain use over some of his accounts as there is support and oversight in the background from the attorney with real-time bank feeds updating the information. This gives confidence to both the attorney and John and is in line with the principle of ‘least restrictive option’ if the alternative is to remove access entirely.

Easy accounts production for attorneys and third parties

Attorneys – particularly family members – are often busy people. At the time of life when they become attorneys they are usually working full-time, raising their own family and perhaps also caring for other older relatives. That means less time to keep an eye on attorneyship finances and less time to put together potentially complicated accounts.

The beauty of Switchfoot Teams – the software system John chose – is that it can produce accounts automatically, using the latest information so that accounts are completely up-to-date and accurate. This satisfies requirements from the Court of Protection and any other sources without attorneys having to spend hours poring over the figures.

So far, so good. But what happens when the appointed attorney can’t manage his or her duties any more? Find out in the final part of our case study.

Partnering with Switchfoot Teams

Switchfoot Wealth has partnered with Switchfoot Teams to provide access to the Switchfoot Teams portal which has been developed to meet the needs of attorneys, deputies and trustees.

To find out more, contact us today.

“

I started Switchfoot Wealth to offer financial planning that matches the way we live and work today. Using the best technology and offering expertise gained through both formal qualifications and years of working closely with clients, we are bringing financial planning into the 21st century, helping people, businesses and professional advisers make the most of their time and their money.

– Sebastian Ewell

Switchfoot Wealth Founder

Read more about Switchfoot Wealth

Related Articles

The Rising Cost of Flood Damage in the UK: What it Means for Your Personal Financial Planning

In this blog post, we’ll explore what the potential implications are for personal financial planning as flood damage costs continue to rise in the UK.

Webinar for home care providers

We welcome SOLLA Affiliate member Claire Edwards of Claire Edwards Eldercare for a presentation designed for home care providers. We discuss the benefits of SOLLA and being a SOLLA Affiliate and also discuss how to support people with continuing health care funding...

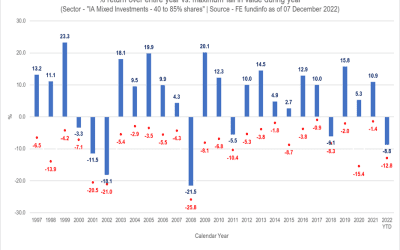

Mind the Gap

Mind the Gap “My investments have reduced in value”. In 2022, this has been one of the main reasons that new clients have shared as to why they are now seeking financial advice. No-one relishes seeing red when logging in to see their investments. However, it’s...

SwitchFoot Wealth Limited is an appointed representative of Sense Network Limited which is authorised and regulated by the Financial Conduct Authority. SwitchFoot Wealth Limited is entered on the Financial Services register (www.fca.org.uk/register) under reference number 808196.

Registered Address: 28 Upper Hale Road, Farnham, Surrey, GU9 0NS. Principal Office: 147 Frimley Road, Camberley, Surrey, GU15 2PS. Registered in England & Wales No.: 11220173.

The information contained within this website is subject to the UK regulatory regime and therefore restricted to consumers based in the UK.

The Financial Ombudsman Service is available to sort out individual complaints that clients and financial services business aren’t able to resolve themselves. To contact the Financial Ombudsman Service, please visit www.financial-ombudsman.org.uk.