Cash flow planning: Tax planning and the affordability of gifting

Responsible financial planning doesn’t just mean suggesting where people should spend or invest their money; it also means making sure that the individual’s wishes are affordable in the short, medium and long terms. Financial advisers have a duty of care to their clients, so by working closely with them to understand their needs, goals and dreams, we can help them to plan sensibly and make informed decisions.

That’s why we believe that cash flow planning is an essential part of private client work – for financial advisers, accountants and solicitors alike. Understanding its importance means we can give better advice and that in turn allows our clients to make the most of what they have.

The affordability of gifting

Understandably, clients often want to gift assets to others – either outright or via a trust mechanism. There are many reasons for deciding to gift, including:

- Saving tax – gifting can be a straightforward way to reduce tax liabilities.

- Helping onto the property ladder – it’s becoming increasingly common for parents to gift a deposit to help children buy their first home.

- Bailing out in an emergency – unexpected circumstances can mean family members want to help out if they can.

- Creating a long-lasting legacy – establishing a trust or giving to a favourite charity are ways of ensuring your gift lives on.

For many, organising gifting is part of a financial planning and tax planning strategy. For others, it’s a big leap, and they can be afraid of committing to giving assets away. Some clients want to retain complete control of their assets – whether cash, investments, property or business – and are unconvinced that gifting should be part of their financial plan. Others worry that they will need the money in the future and can’t afford to give it away.

How cash flow planning can help

It’s our job as professional advisers to look at forward cash flow planning, both to make sure that the gifting requirements are affordable, and to give clients advice on when and how best to manage their gifts. This includes:

- Helping clients to visualise the short, medium and long-term effect on their finances

- Making sure they understand the long-term tax savings potential

- Test a range of ‘what if scenarios, including:

- stock market crashes

- they or their partner suddenly needs long term care

- roof falls off or other home disasters

- bereavement

Tax planning – quantifying the savings over the long term

For financial advisers, ‘long term’ often goes beyond the lifespan of the client – good tax planning is about having a positive impact that affects the next decades and the next generation of the family.

Tax planning means you can explain the value of your advice in this long-term scenario: it’s not just about being solvent for the next few years – it’s about the financial security of the client, their family, their business and their other interests. A service that often may seem expensive at the time brings huge dividends in terms of tax saved over this long-term period.

Justifying and Explaining the value of your advice.

For accountants and solicitors, good cash flow and tax planning enhances your legal advice and can help you to provide better, more compliant, less risky advice.

If you would like to know more about how Switchfoot Wealth can compliment legal and accountancy advice, please get in contact with Sebastian today.

“

I started Switchfoot Wealth to offer financial planning that matches the way we live and work today. Using the best technology and offering expertise gained through both formal qualifications and years of working closely with clients, we are bringing financial planning into the 21st century, helping people, businesses and professional advisers make the most of their time and their money.

– Sebastian Ewell

Switchfoot Wealth Founder

Read more about Switchfoot Wealth

Related Articles

The Rising Cost of Flood Damage in the UK: What it Means for Your Personal Financial Planning

In this blog post, we’ll explore what the potential implications are for personal financial planning as flood damage costs continue to rise in the UK.

Webinar for home care providers

We welcome SOLLA Affiliate member Claire Edwards of Claire Edwards Eldercare for a presentation designed for home care providers. We discuss the benefits of SOLLA and being a SOLLA Affiliate and also discuss how to support people with continuing health care funding...

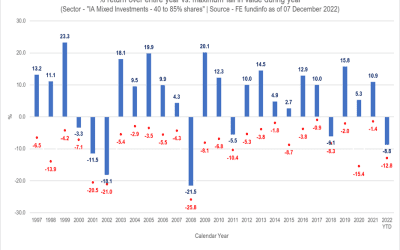

Mind the Gap

Mind the Gap “My investments have reduced in value”. In 2022, this has been one of the main reasons that new clients have shared as to why they are now seeking financial advice. No-one relishes seeing red when logging in to see their investments. However, it’s...

SwitchFoot Wealth Limited is an appointed representative of Sense Network Limited which is authorised and regulated by the Financial Conduct Authority. SwitchFoot Wealth Limited is entered on the Financial Services register (www.fca.org.uk/register) under reference number 808196.

Registered Address: 28 Upper Hale Road, Farnham, Surrey, GU9 0NS. Principal Office: 147 Frimley Road, Camberley, Surrey, GU15 2PS. Registered in England & Wales No.: 11220173.

The information contained within this website is subject to the UK regulatory regime and therefore restricted to consumers based in the UK.

The Financial Ombudsman Service is available to sort out individual complaints that clients and financial services business aren’t able to resolve themselves. To contact the Financial Ombudsman Service, please visit www.financial-ombudsman.org.uk.